- May 22, 2024

- Posted by: Finanalyz

- Categories: Retirement Planning, Small Business Finances

In recent years, India has experienced a surge in fintech innovations, fueled by digitalization and smartphone adoption. In this blog, we’ll delve into key drivers of growth, popular digital solutions, revolutionary lending practices, and the expanding horizons of fintech. Join us as we navigate through this dynamic landscape and understand how fintech is transforming India’s financial future.

Table of contents:

Introduction to the Indian Fintech Market

Key Drivers of Fintech Growth in India

Popular Fintech Solutions: Mobile Wallets and Payment Platforms

Revolutionizing Lending with Fintech

Expanding Horizons: Insurance, Wealth Management, and Investment Banking

Challenges in the Indian Fintech Sector

Introduction to the Indian Fintech Market

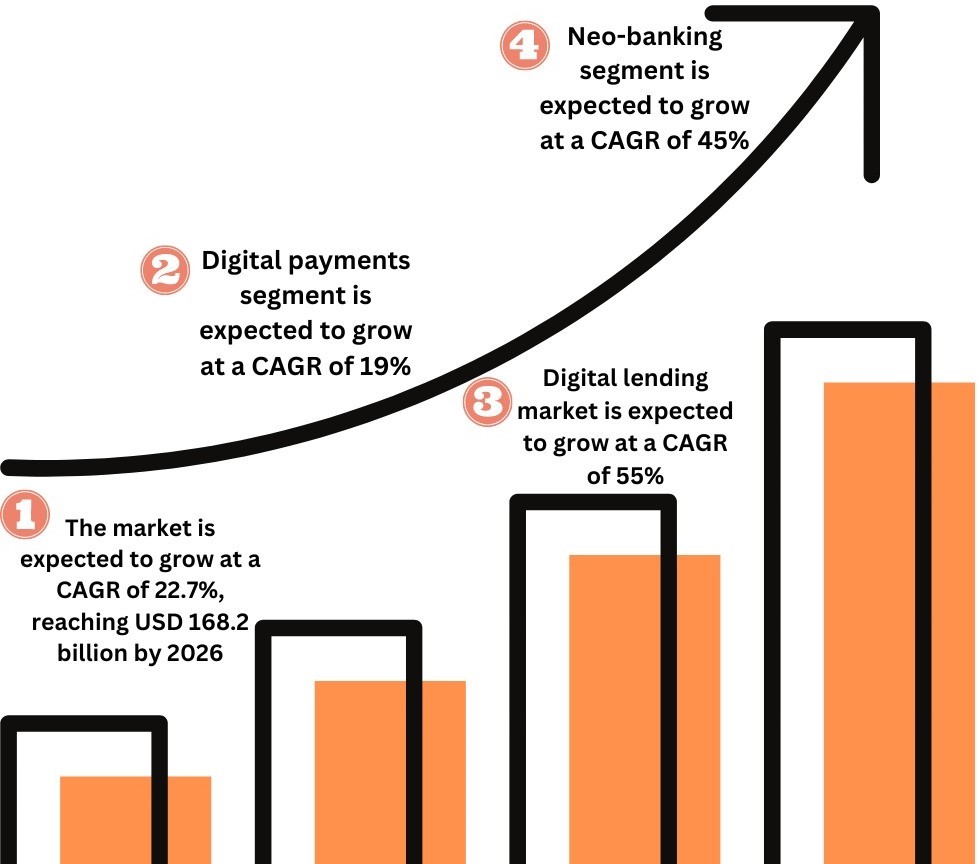

In recent years, the Indian fintech market has experienced remarkable expansion, propelled by governmental initiatives promoting digitalization and the rising prevalence of smartphones and mobile internet usage. A report by the National Association of Software and Services Companies (NASSCOM) forecasts that the fintech sector in India will achieve a valuation of $150 billion by 2025. This surge underscores the significant impact of fintech in reshaping India’s financial sector.

Key Drivers of Fintech Growth in India

The burgeoning fintech market in India owes much of its expansion to the surging demand for financial services across the nation. With a population exceeding 1.3 billion, India presents a vast and promising market for financial offerings. Yet, conventional banks and financial entities have encountered obstacles in reaching the extensive rural populace, hindered by inadequate physical infrastructure and soaring expenses. This disparity has cultivated fertile terrain for fintech enterprises to flourish, leveraging inventive and readily accessible digital solutions.

Popular Fintech Solutions: Mobile Wallets and Payment Platforms

Fintech companies have stepped in, offering digital solutions that are accessible to everyone, regardless of their location or income. Mobile wallets and digital payment platforms have become particularly popular, with companies like Paytm and PhonePe leading the way. These platforms have revolutionized the way people transact, making financial services more inclusive and bridging the gap between urban and rural populations.

Revolutionizing Lending with Fintech

Fintech firms are exerting a notable influence in the lending sphere, particularly targeting small and medium-sized enterprises (SMEs). Traditional banks historically hesitated to extend loans to such entities due to perceived high risks. Nonetheless, fintech enterprises are pioneering the use of alternative data reservoirs and groundbreaking technologies to evaluate creditworthiness, consequently facilitating loans at reduced interest rates. This accessibility has empowered numerous small businesses to secure the necessary capital for expansion and prosperity.

Expanding Horizons: Insurance, Wealth Management, and Investment Banking

Revolutionizing Financial Services: Fintech’s Diverse Ventures

In recent years, the fintech sector in India has witnessed a remarkable expansion beyond its traditional domains, with companies exploring new frontiers such as insurance, wealth management, and investment banking. This diversification reflects a growing appetite for innovative financial solutions and underscores the transformative potential of fintech in reshaping India’s financial landscape.

Innovative Solutions in Insurance: Redefining Accessibility and Affordability

Fintech firms like PolicyBazaar have emerged as key players in the insurance sector, leveraging technology to simplify the insurance buying process and make coverage more accessible and affordable to a wider audience. Through online platforms and advanced data analytics, these companies empower consumers to compare policies, assess their needs, and make informed decisions about their insurance coverage, driving greater transparency and efficiency in the market.

Empowering Investors: Fintech’s Role in Democratizing Wealth Management

Zerodha and similar platforms have democratized wealth management by providing retail investors with low-cost brokerage services, intuitive trading platforms, and educational resources. Through these initiatives, fintech companies like FinAnalyz which are breaking down barriers to entry and empowering individuals of all backgrounds to participate in the financial markets, build wealth, and achieve their long-term financial goals.

Challenges in the Indian Fintech Sector

Even amidst the swift expansion of the Indian fintech arena, several hurdles persist that warrant attention. Foremost among these challenges is the ambiguity surrounding regulatory frameworks. Fintech enterprises navigate a labyrinth of regulations, encountering varying stipulations and licensing prerequisites across different service categories. Additionally, there remains a pressing demand for heightened financial literacy among the populace. Particularly in rural regions, a significant portion of the Indian populace remains unfamiliar with digital financial solutions and their utilization, underscoring the imperative for widespread education on these fronts.

The Role of Financial Literacy in Fintech Adoption

Within the realm of Personal Finance Management, FinAnalyz has emerged as a standout player, offering users tailored financial recommendations derived from comprehensive evaluations of their income, expenses, and future objectives. Through meticulous scrutiny of your financial landscape, FinAnalyz not only identifies avenues for saving but also offers insights into optimizing expenditure, facilitating budgetary allocations for vacations. Recognizing the paramount importance of financial literacy, FinAnalyz equips users with the knowledge and tools necessary to make enlightened choices, thereby maximizing the advantages afforded by digital financial services.

FAQs

What is driving the growth of the Indian fintech market?

The growth of the Indian fintech market is primarily driven by the government’s push towards digitalization, the widespread adoption of smartphones and mobile internet, and the increasing demand for financial services among the country’s vast population.

How big is the Indian fintech market expected to become?

According to a report by the National Association of Software and Services Companies (NASSCOM), the Indian fintech market is projected to reach a valuation of $150 billion by 2025, highlighting its significant growth potential.

What are some popular fintech solutions in India?

Mobile wallets and digital payment platforms have gained widespread popularity in India, with companies like Paytm and PhonePe leading the way. These platforms offer convenient and accessible solutions for everyday financial transactions.

How are fintech companies revolutionizing lending practices in India?

Fintech companies are leveraging alternative data sources and innovative technologies to assess creditworthiness and offer loans at lower interest rates, particularly to small and medium-sized businesses. This has democratized access to credit and fueled entrepreneurial growth.

What are the challenges faced by the Indian fintech sector?

Some of the main challenges include regulatory ambiguity, varying regulations and licensing requirements for different services, and the need for greater financial literacy among the population, especially in rural areas where digital financial services are less familiar.

How is fintech poised to transform India’s financial landscape?

Fintech has the potential to democratize financial services, making them more accessible and inclusive. By bridging gaps in traditional banking services and offering innovative solutions, fintech is driving financial inclusion and empowerment across India, paving the way for a more digitally enabled economy.

Conclusion

In conclusion, the Indian fintech market is experiencing unprecedented growth, driven by digitalization and technological innovation, with a projected valuation of $150 billion by 2025. From mobile wallets to lending platforms, fintech solutions offered by companies like FinAnalyz are revolutionizing financial services, making them more accessible and affordable. However, challenges such as regulatory ambiguity and the need for greater financial literacy persist. Despite these obstacles, FinAnalyz remains committed to leveraging its expertise and cutting-edge technology to address these challenges and drive financial inclusion across India. As the fintech sector continues to evolve, FinAnalyz stands poised to play a pivotal role in shaping a more prosperous and digitally enabled future for individuals and businesses alike.