POWERING DIGITAL LENDING WITH INTELLIGENT LOS & LMS

Incubated With

FinAnalyz incubated with various financial institutions, using their expertise to refine strategies, analyze market trends, and innovate solutions.

End-to-End Data Verification Flow

FinKYC

Provide Data Required

Verification & Authentication

Collection & Aggregation

Analyze Bank Statements & GST

Credit Bureau Pull & Risk Scoring

Underwriting & Approval Workflow

Continuous Monitoring & Alerts

Core Platform Capabilities

Loan Origination System (LOS)

FinAnalyz LOS digitizes the complete lending journey from customer onboarding to loan disbursement, enabling lenders to process applications faster while maintaining regulatory compliance and strong risk controls.

By combining real-time data verification, automated underwriting, and configurable workflows, LOS enables early risk identification and stronger credit decisions right from the origination stage.

What FinAnalyz LOS Delivers

-

End-to-end origination from onboarding to disbursement

-

Automated KYC, document verification, and data validation

-

Integrated financial analysis using bank statements and GST data

-

Rule-based underwriting with configurable approval workflows

-

Real-time application tracking with MIS and audit trails

Loan Management System (LMS)

FinAnalyz LMS enables lenders to manage the entire post-disbursement loan lifecycle with accuracy and operational efficiency.

From repayment schedules and collections to customer servicing and compliance, LMS ensures greater visibility, automation, and control across every active loan account helping minimize NPAs and improve portfolio performance.

What FinAnalyz LMS Delivers

-

-

Centralized management of active loan portfolios

-

Automated EMI schedules, collections, and repayments

-

Real-time loan status, customer servicing, and account updates

-

Integrated delinquency tracking and recovery workflows

-

Compliance-ready reporting with detailed MIS and audit trails

-

Platform Capabilities at a Glance

LOS

- End to end origination from onboarding to disbursement

- Early risk identification during loan origination

- Centralized document management and validation

- Flexible configuration for multiple loan products

- Faster turnaround time with reduced manual intervention

- Automated loan decisioning using financial, identity, and risk data

LMS

- Real time monitoring of loan accounts and customer data

- Early delinquency detection and risk alerts

- Automated repayment, collection, and follow up processes

- Centralized customer, loan, and transaction data

- Detailed operational, financial, and regulatory reports

- Improved control over NPAs and portfolio performance

A Complete Lending Ecosystem

Powerful capabilities that strengthen risk control, compliance, and lending efficiency

GST Analysis

Our GST Analysis solution helps lenders assess borrower financial health using GST data by analyzing returns, validating information, evaluating turnover and cash flow, and delivering insights for stronger credit and underwriting decisions.

Bank Statement Analysis

FinAnalyz’s Automated Bank Statement Analysis processes multi-bank statements to deliver cash flow, income, and expense insights, enabling faster and more accurate credit evaluation with minimal manual effort.

Cybersecurity Solutions

FinAnalyz’s Cybersecurity Solutions protect financial data and ensure platform reliability through data protection, secure architecture, risk monitoring, and compliance with security best practices.

Loan Underwriting Solutions

FinAnalyz’s Intelligent Loan Underwriting combines data, rules, and analytics with bureau integrations to deliver accurate credit decisions, risk scoring, and reduced NPAs.

ITR Analysis

FinAnalyz’s ITR Analysis evaluates borrower income, tax compliance, and financial consistency by analyzing Income Tax Returns, helping lenders strengthen credit assessment and underwriting accuracy.

KYC & KYB API Suite

FinAnalyz’s Digital KYC & KYB API Suite enables fast, secure customer and business verification with real-time integrations, supporting PAN, Aadhaar, CKYC, DigiLocker, and KYB checks for quicker onboarding and reduced fraud risk.

Who FinAnalyz Is Built For

NBFCs

End-to-end digital lending operations with stronger risk control and regulatory compliance.

Banks

Secure, scalable LOS and LMS to modernize lending workflows and improve operational efficiency.

Fintech Lending Platforms

API-driven, configurable infrastructure built for rapid innovation and high-volume lending.

Microfinance Institutions (MFIs)

Simplified loan processing, monitoring, and collections for high-touch, high-frequency lending models.

Digital-First Lenders

Fully digital onboarding, instant decisioning, and seamless borrower experiences at scale.

SME & Business Lenders

Advanced underwriting using GST, bank statements, and cash-flow data for smarter business lending.

Meet Our Finanalyz Team

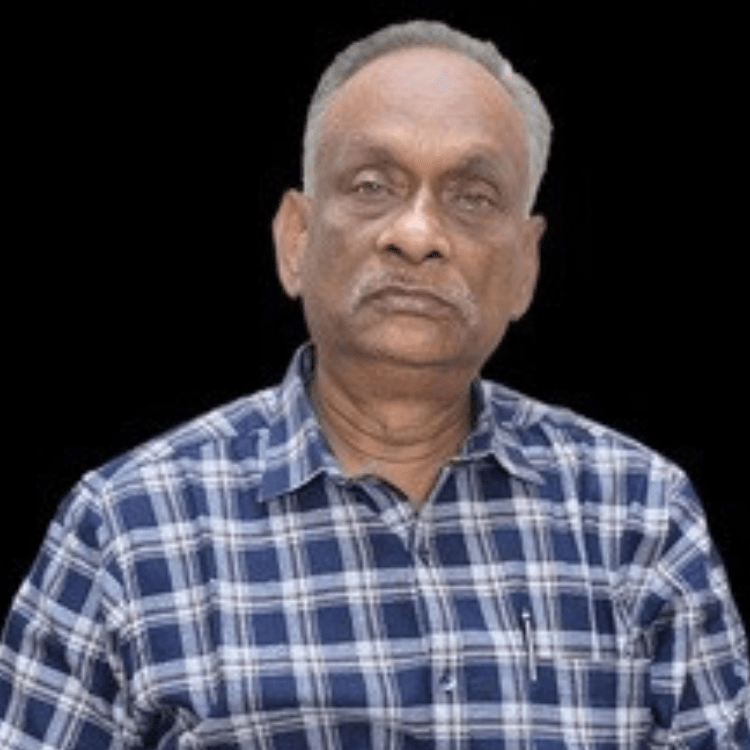

Founder & CEO

Jagannadha Rao

- A Cost Accountant, MBA, Certified

PMP, Certified Six Sigma Green

Belt. - 27+ years experience in ITES/BPO

and in Financial Industry, worked at

EY, JP Morgan, PWC. - 6+ years experienced Start-up

advisor.

Co-Founder & CFO

Aashish Joshi

- A Chartered Accountant

- 12+ years of experience

in Accounts, Audit, and

Taxation.

Business Head

Ganesh Srinivasan

- Post Graduate in Marketing

- 30+ years of experience in

Business Development.

Product Head

Gokul Prabhu S

- MS in Engineering, University of

Pasadena - MBA in Technical Entrepreneurship

- 7+ years of experience in product

development, product

management, and strategic

partnerships.

Strategic Head

Jyoti Sahu

- A CMA Intermediate

- Accounting and Finance Honours

Graduate - Strategic Business Development

Professional with over 7 years of

experience in BusinessDevelopment and Entrepreneurship

Tech Head

Abhay Solanke

- B.E (E&TC)

- M.Tech

- Data Scientist

- Having 4+ years of

experience in Ai/ Data

Science/ Machine

Learning field.

Account Aggregator Partners

FinAnalyz partnered with Account Aggregators to make it easier for people to access and manage financial information.

FinAnalyz empowers financial institutions with a secure, scalable, and configurable digital lending platform that supports smarter origination, continuous post disbursement monitoring, reduced NPAs, and long term operational excellence.