- June 9, 2024

- Posted by: Finanalyz

- Categories: Financial Apps & Tools, Financial Independence & Early Retirement, Financial Literacy, Financial Wellness

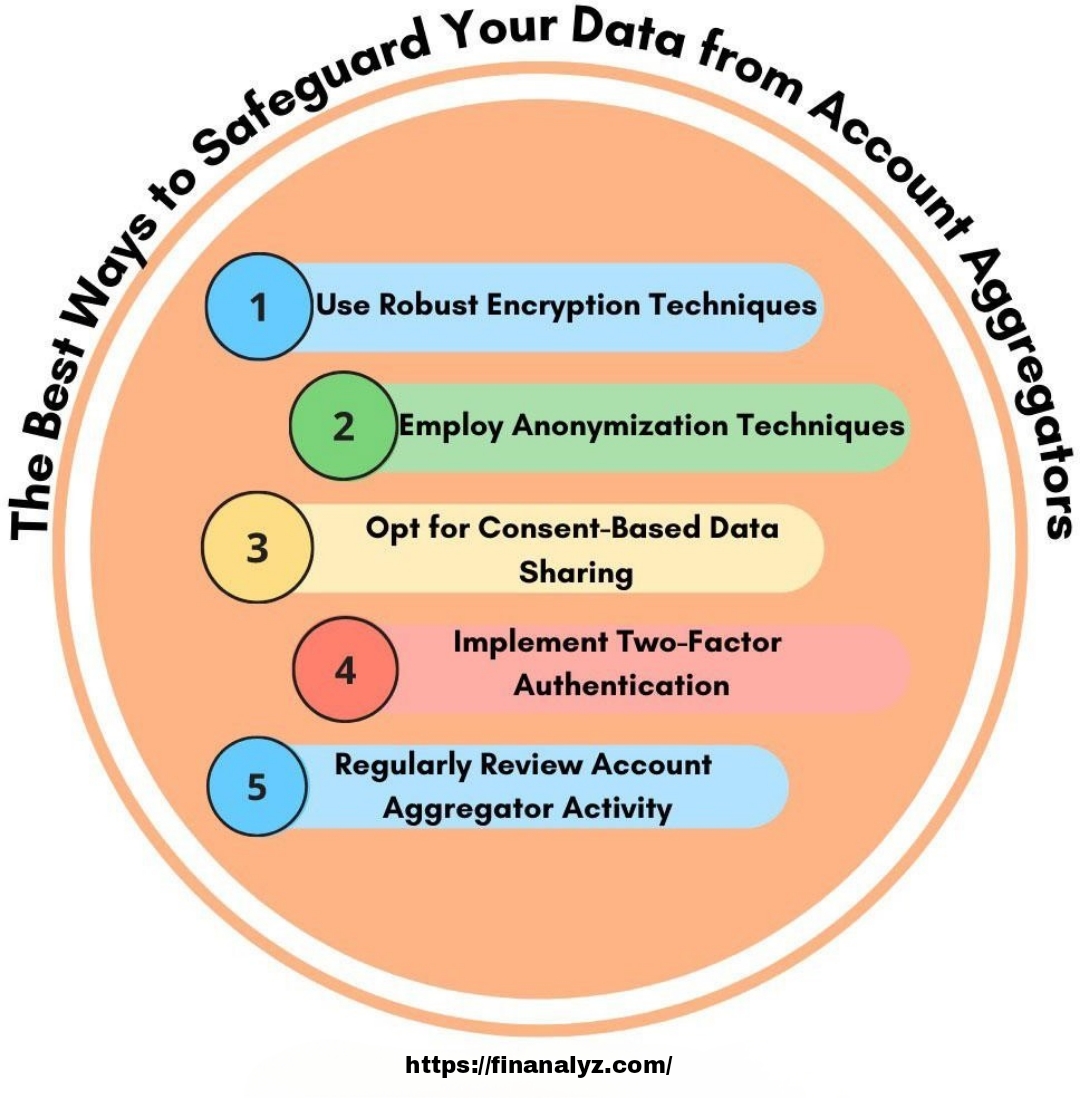

When it comes to managing your finances, navigating the complexities of data security and efficiency can be challenging. Account aggregators simplify this process by consolidating your financial information from multiple sources into one platform. This comprehensive guide will explore the essential aspects of financial security and efficiency provided by account aggregators, helping you make informed decisions about safeguarding and optimizing your financial data. From robust encryption techniques to anonymization methods and consent-based data sharing, we’ll cover everything you need to know to protect your financial information and make the most of account aggregator services.

Introduction

When it comes to managing your finances, navigating the complexities of data security and efficiency can be challenging. Account aggregators simplify this process by consolidating your financial information from multiple sources into one platform. This blog will explore the essential aspects of financial security and efficiency provided by account aggregators, helping you make informed decisions about safeguarding and optimizing your financial data.

Robust Encryption Techniques

Encrypting your data is essential to ensure its security. When selecting an account aggregator, prioritize providers that offer strong encryption algorithms, such as end-to-end encryption and SSL/TLS protocols. These techniques protect your sensitive information during transmission and storage, creating a robust barrier that is difficult for unauthorized entities to bypass.

Employ Anonymization Techniques

Anonymization is crucial for making your data invisible to AI detectors. Before sharing your information with account aggregators, use methods like data masking, pseudonymization, and tokenization. These techniques remove personally identifiable information (PII) and replace it with anonymous identifiers, reducing the risk of your data being traced back to you.

Opt for Consent-Based Data Sharing

Be cautious when granting permissions to account aggregators. Carefully review the terms, privacy policies, and permissions requested. Choose platforms that prioritize user consent and allow you granular control over data sharing. Ensure the aggregator follows industry best practices, obtaining explicit consent for data collection, storage, and sharing.

Implement Two-Factor Authentication (2FA)

Two-factor authentication adds an extra layer of security to your accounts, making unauthorized access more difficult. Enable 2FA to protect your data, ensuring that even if it is detected, it remains secure behind an additional verification step.

Regularly Review Account Aggregator Activity

Stay vigilant by actively monitoring the activity of your account aggregators. Regularly review the access and permissions granted. If you notice any suspicious activity, promptly investigate and take action. Proactive monitoring helps detect potential breaches early and minimizes the risk of unauthorized access.

Use Cases of Account Aggregators

- Comprehensive Financial Dashboard: Aggregate and view your financial accounts from different institutions in one place, tracking your overall financial health.

- Expense Tracking and Budgeting: Categorize and analyze expenses from multiple accounts to gain insights into spending patterns and improve budgeting.

- Income Verification for Loans and Applications: Streamline loan applications by securely sharing financial data with lenders, reducing manual document submission.

- Investment Portfolio Analysis: Consolidate investment data to get a comprehensive view of your portfolio, assess asset allocation, and monitor performance.

- Tax Planning and Reporting: Simplify tax planning by consolidating financial data, making it easier to file accurate returns and maximize deductions.

- Personalized Financial Insights and Recommendations: Use AI and data analytics to receive tailored financial advice based on your spending patterns and goals.

- Simplified Insurance and Claims Management: Aggregate insurance policies in one place for easier management and streamlined claims processing.

- Personal Financial Management Apps Integration: Integrate with PFM apps for enhanced budgeting, goal tracking, and expense management functionalities.

Account Aggregator Services

- Account Data Aggregation: Consolidate financial data from multiple sources into a single platform.

- Financial Data Storage and Security: Securely store financial data with robust security measures and encryption.

- Consent Management: Facilitate secure and authorized data sharing, giving users control over their data access.

- Data Analytics and Insights: Analyze aggregated data to provide valuable insights into spending habits and investment performance.

- Loan and Credit Application Facilitation: Streamline loan applications by securely sharing financial data with lenders.

FAQs

1. What is an Account Aggregator?

An Account Aggregator (AA) is a platform that consolidates financial information from multiple sources, such as banks, credit cards, and investment accounts, into a single, unified interface. This helps users manage their finances more effectively by providing a comprehensive overview of their financial status.

2. How does encryption protect my financial data?

Encryption protects your financial data by converting it into a coded format that is unreadable to unauthorized users. Techniques such as end-to-end encryption and SSL/TLS protocols ensure that your data is secure during transmission and storage, making it difficult for hackers or unauthorized entities to access or intercept your information.

3. What are anonymization techniques, and why are they important?

Anonymization techniques such as data masking, pseudonymization, and tokenization remove personally identifiable information (PII) from your data. These methods replace sensitive data with anonymous identifiers, making it difficult for AI detectors or unauthorized users to trace the information back to you. This enhances your privacy and security.

4. Why is consent-based data sharing crucial when using account aggregators?

Consent-based data sharing ensures that you have control over what information is shared and with whom. By carefully reviewing terms, privacy policies, and permissions, you can prevent unauthorized access to your data. Platforms that prioritize user consent and allow granular control over data sharing protect your privacy and reduce the risk of misuse.

5. How does two-factor authentication (2FA) enhance security?

Two-factor authentication (2FA) adds an extra layer of security by requiring two forms of verification before granting access to your accounts. This could include something you know (password), something you have (a smartphone or hardware token), or something you are (biometric verification). Enabling 2FA makes it significantly harder for unauthorized users to access your financial data.

6. What are the key use cases of account aggregators?

Account aggregators have several use cases, including providing a comprehensive financial dashboard, expense tracking and budgeting, income verification for loans and applications, investment portfolio analysis, tax planning and reporting, personalized financial insights and recommendations, and simplified insurance and claims management. These use cases help users efficiently manage their financial health.

7. What should I look for in an account aggregator service?

When choosing an account aggregator service, look for features such as robust encryption techniques, effective anonymization methods, user consent-based data sharing, and two-factor authentication. Additionally, ensure the service offers comprehensive data aggregation, secure data storage, consent management, insightful data analytics, and streamlined loan and credit application facilitation. These features ensure the security and efficiency of managing your financial information.

Conclusion

FinAnalyz is here to get all your financial accounts under one roof. Fintech companies, personal finance/investment management organizations, and product companies that focus on customer digital experience, analytics, and research can leverage FinAnalyz as a cost-effective solution for personal finance management.