Product Capabilities

FinAnalyz Product Capabilities

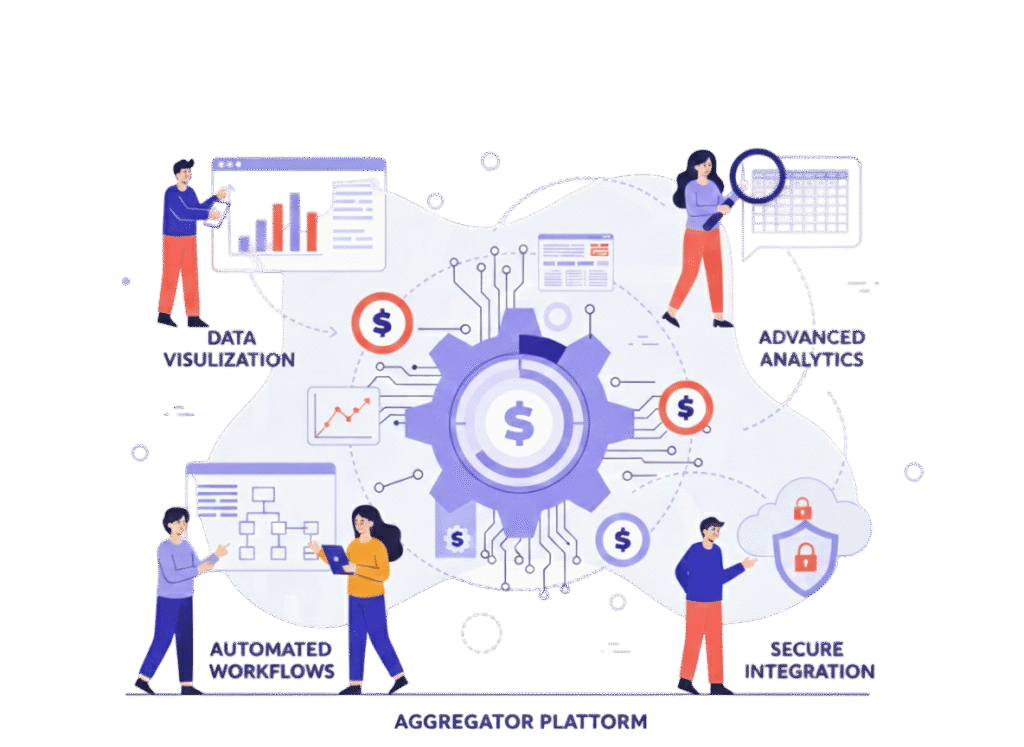

FinAnalyz delivers robust financial data aggregation and analytics capabilities that transform complex financial information into actionable intelligence. The platform enables lenders and financial institutions to analyze cash flows, assess risk, and forecast financial behavior with accuracy. Through standardized data, advanced analytics, and intuitive reporting, FinAnalyz simplifies financial analysis workflows, reduces manual effort, and supports faster, more informed decision-making across lending and financial operations.

Platform Capabilities at a Glance

LOS

- End to end origination from onboarding to disbursement

- Early risk identification during loan origination

- Centralized document management and validation

- Flexible configuration for multiple loan products

- Faster turnaround time with reduced manual intervention

- Automated loan decisioning using financial, identity, and risk data

LMS

- Real time monitoring of loan accounts and customer data

- Early delinquency detection and risk alerts

- Automated repayment, collection, and follow up processes

- Centralized customer, loan, and transaction data

- Detailed operational, financial, and regulatory reports

- Improved control over NPAs and portfolio performance

A Complete Lending Ecosystem

Powerful capabilities that strengthen risk control, compliance, and lending efficiency

GST Analysis

Our GST Analysis solution helps lenders assess borrower financial health using GST data by analyzing returns, validating information, evaluating turnover and cash flow, and delivering insights for stronger credit and underwriting decisions.

Bank Statement Analysis

FinAnalyz’s Automated Bank Statement Analysis processes multi-bank statements to deliver cash flow, income, and expense insights, enabling faster and more accurate credit evaluation with minimal manual effort.

Cybersecurity Solutions

FinAnalyz’s Cybersecurity Solutions protect financial data and ensure platform reliability through data protection, secure architecture, risk monitoring, and compliance with security best practices.

Loan Underwriting Solutions

FinAnalyz’s Intelligent Loan Underwriting combines data, rules, and analytics with bureau integrations to deliver accurate credit decisions, risk scoring, and reduced NPAs.

ITR Analysis

FinAnalyz’s ITR Analysis evaluates borrower income, tax compliance, and financial consistency by analyzing Income Tax Returns, helping lenders strengthen credit assessment and underwriting accuracy.

KYC & KYB API Suite

FinAnalyz’s Digital KYC & KYB API Suite enables fast, secure customer and business verification with real-time integrations, supporting PAN, Aadhaar, CKYC, DigiLocker, and KYB checks for quicker onboarding and reduced fraud risk.