- May 16, 2024

- Posted by: Finanalyz

- Categories: Budgeting, Financial Planning for Major Life Events, Financial Wellness, Saving & Investing

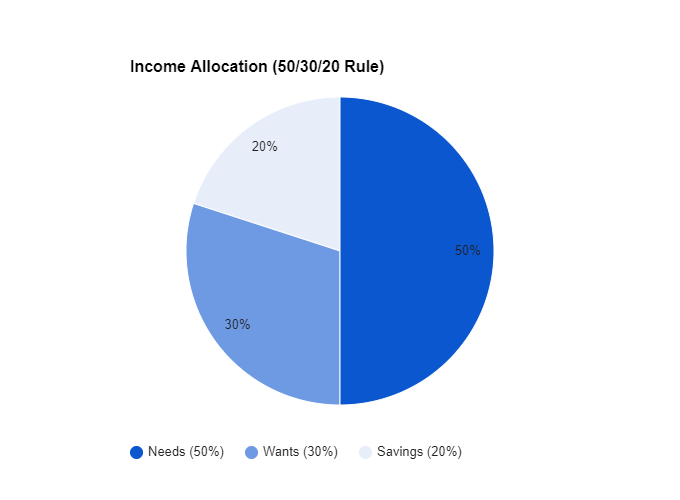

Everyone needs to keep track of their daily expenses and the best way to do it is to create a budget for everything and stick to it. A budget will keep your expenses in check and helps you avoid overspending and help you with planning to achieve your financial goals. While expenses depend on person to person , the 50/30/20 rule should be the foundation when planning your budget. This rule suggests that you spend 50% of your income on needs, 30% on your wants and 20% should go to savings and investment.

Understanding Your Income

The first step is to figure out your net monthly income. Once you know how much money gets in your bank account every month, it becomes the foundation upon which any future planning is to be done. Assuming your monthly income is X, then 0.5x should go towards your needs, 0.3x should go towards your wants and 0.2x should be for savings and investments alone.

Allocating Your Income According to the 50/30/20 Rule

The 50/30/20 rule is a budgeting method where you allocate 50% of your income to essential expenses (housing, groceries, utilities, etc.), 30% to discretionary spending (entertainment, dining out), and 20% towards savings and debt repayment. This is a flexible guideline and can be adjusted based on your financial goals and situation. By understanding your income and applying this method, you can create a budget that helps you achieve financial stability.

| Income | $$5000.00 |

| Needs (50%) | $$2500.00 |

| Wants (30%) | $$1500.00 |

| Savings (20%) | $$1000.00 |

Tracking Your Expenses

Calculate the essential monthly expenses like groceries, rent, bills and make sure that total sum doesn’t exceed 50% of your monthly income. Given this is where you will spend most of your money, here you can find the most room to squeeze your budget and note down every penny you spend and look for places where you cut costs

Setting Achievable Financial Goals

Now that you know how much of your money goes where. Set your financial goals that are achievable in the medium to long run. These goals comprise of savings for a house, insurance goals, investment planning.

Adjusting Spending Habits

Feeling like your spending is out of control? You’re not alone! Adjusting spending habits is a common challenge. The key is to be mindful and strategic. Track your spending to identify areas for improvement. Prioritize needs over wants, and create a budget to allocate your income effectively.

Curb impulse purchases by implementing a “waiting period” before buying non-essential items. Explore cost-saving alternatives like home-cooked meals and free entertainment. Leverage technology with budgeting and price comparison apps. Be mindful while shopping by planning trips with lists and avoiding marketing tactics. Remember, change takes time. Set realistic goals, reward yourself for progress, and be patient. By taking control of your spending, you’ll be well on your way to achieving your financial goals.

Regularly Reviewing and Adjusting Your Budget

here’s how to regularly review and adjust it:

Schedule Regular Check-Ins:

- Weekly or Monthly: Briefly review your spending compared to your budget. Identify areas of overspending or underspending.

- Quarterly or Biannually: Conduct a more in-depth review. Analyze income changes, upcoming expenses, and progress towards financial goals.

Scrutinize Income and Expenses:

- Track Income Fluctuations: Has your income increased or decreased? Adjust your budget allocations accordingly.

- Review Spending Patterns: Are there recurring overspending categories? Identify areas for cutbacks or adjustments.

- Evaluate Fixed Expenses: Look for opportunities to renegotiate bills or explore cheaper alternatives (cable, phone plans).

Embrace Flexibility:

- Life Changes: Major life events (job change, child birth) necessitate budget adjustments.

- Saving Goals: Re-evaluate your savings goals as needed. Are you on track for retirement or a down payment?

FAQs

1. Why is creating a budget important?

Creating a budget is crucial because it helps you track your income and expenses, ensuring you live within your means. It enables you to allocate money towards essential needs, savings, and discretionary spending. A budget also helps you identify areas where you can cut costs and save more, ultimately supporting your financial goals and stability.

2. What is the 50/30/20 rule, and how can it help me manage my money?

The 50/30/20 rule is a simple budgeting framework that allocates 50% of your income to needs (essentials like rent, groceries, and utilities), 30% to wants (non-essentials like dining out and entertainment), and 20% to savings and investments. This rule helps you balance your spending, prioritize saving, and ensure you’re not overspending on discretionary items.

3. How often should I review and adjust my budget?

It’s recommended to review and adjust your budget at least once a month. Regular reviews allow you to track your spending, compare it against your budget, and make necessary adjustments. Frequent reviews also help you stay aligned with your financial goals and adapt to any changes in your financial situation.

4. What should I do if I consistently overspend in certain budget categories?

If you find yourself consistently overspending in certain categories, start by identifying the reasons behind the overspending. Look for ways to reduce costs, such as cutting back on non-essential expenses or finding cheaper alternatives. You may also need to adjust your budget to allocate more funds to those categories while reducing spending in others to maintain overall balance.

5. How can I stay motivated to stick to my budget?

Staying motivated to stick to your budget involves setting clear, achievable financial goals and regularly tracking your progress. Celebrate small milestones and successes along the way. Additionally, remind yourself of the long-term benefits of budgeting, such as financial stability, reduced stress, and the ability to afford big-ticket items or experiences in the future. Using budgeting tools or apps can also make the process more engaging and easier to manage.

Conclusion

Managing your money with a budget is essential for achieving financial stability and reaching your financial goals. By tracking daily expenses and adhering to a structured budget, such as the 50/30/20 rule, you can avoid overspending and make informed decisions. Start by calculating your monthly income and essential expenses, then set achievable financial goals. Adjust your spending habits to prioritize savings and investments, and regularly review your budget to stay on track. Budgeting isn’t just about limiting spending; it’s about making your money work for you. Stay disciplined, make informed adjustments, and watch your financial health improve over time. For more tips, visit FinAnalyz for comprehensive insights on personal finance management.