- May 17, 2024

- Posted by: Finanalyz

- Categories: Family Finances, Financial Independence & Early Retirement, Financial Wellness

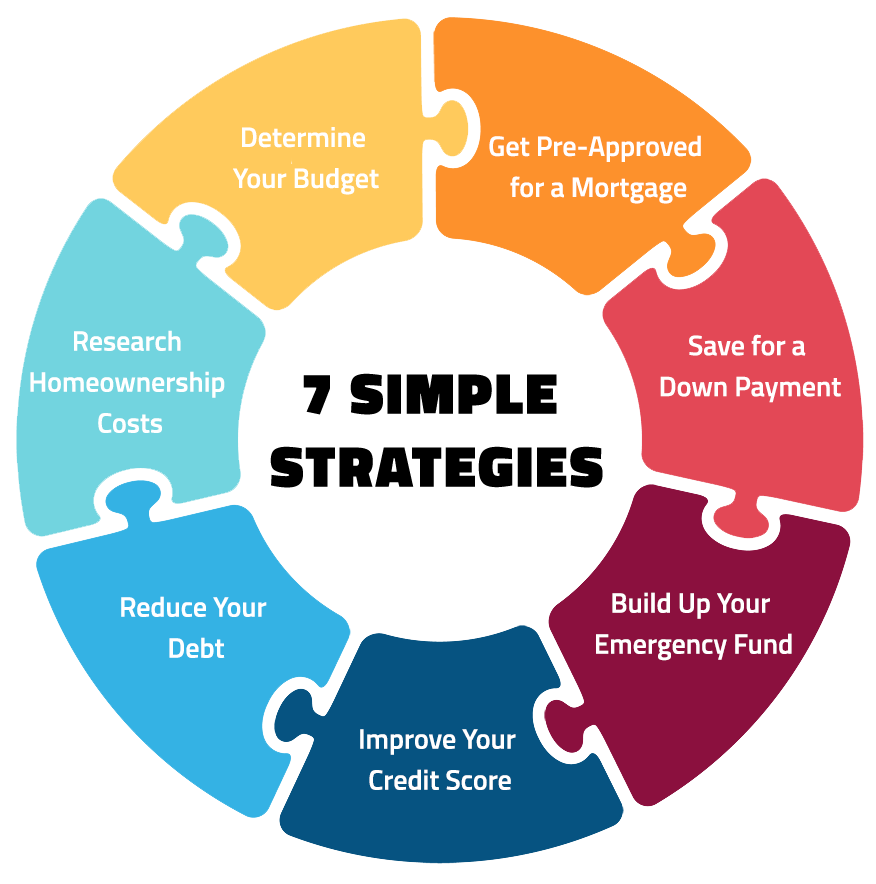

Buying a home is a big decision, and one that comes with significant financial implications. It’s not just about the purchase price; there are a host of other expenses that come with homeownership, including property taxes, insurance, maintenance costs, and more. Therefore, before taking the plunge and buying a home, it’s important to make sure that you are financially ready. In this article, we’ll explore seven simple strategies that can help you do just that.

Determine Your Budget

The first step in preparing to buy a home is to determine your budget. This involves taking a close look at your income, expenses, and savings to figure out how much you can realistically afford to spend on a home. You should also take into account any debt you have, such as student loans or credit card debt, as this will impact your ability to qualify for a mortgage.

Get Pre-Approved for a Mortgage

Once you’ve determined your budget, the next step is to get pre-approved for a mortgage. This will give you a better idea of how much you can actually borrow from a lender, and will help you narrow down your search to homes that are within your price range. It’s important to note that being pre-approved for a mortgage is not the same as being approved for a mortgage, but it is a good first step.

Save for a Down Payment

One of the biggest financial hurdles to buying a home is coming up with a down payment. While it is possible to get a mortgage with a small down payment, it’s generally recommended that you aim to put down at least 20% of the purchase price. This will not only help you qualify for a better mortgage rate, but it will also reduce your monthly payments and save you money in the long run. Start saving early to give yourself plenty of time to accumulate the necessary funds.

Build Up Your Emergency Fund

Owning a home comes with unexpected expenses, such as a broken water heater or a leaky roof. To prepare for these inevitable costs, it’s important to have an emergency fund. Aim to save at least three to six months’ worth of living expenses in a separate account that you can access easily if needed.

Improve Your Credit Score

Your credit score plays a crucial role in your ability to get approved for a mortgage and secure a favorable interest rate. To improve your credit score, pay your bills on time, keep your credit card balances low, and avoid opening new lines of credit unless absolutely necessary.

Reduce Your Debt

High levels of debt can make it difficult to qualify for a mortgage, so it’s a good idea to work on reducing your debt before applying for a home loan. Pay off high-interest credit card debt, and consider consolidating any other debts into a lower-interest loan to make payments more manageable.

Research Homeownership Costs

Finally, it’s important to research the costs associated with homeownership beyond the purchase price. This includes property taxes, homeowners insurance, maintenance and repair costs, and any homeowners association fees. Make sure to budget for these expenses so you are fully prepared for the financial responsibility of owning a home.

Leveraging Homebuyer Assistance Programs

Exploring homebuyer assistance programs can significantly ease the financial burden of purchasing a home. Many first-time homebuyers can benefit from grants and down payment assistance programs offered by federal, state, and local governments. These programs can provide financial aid, lower interest rates, and tax incentives, making homeownership more accessible. Research the options available in your area to take full advantage of these opportunities. Additionally, some non-profit organizations and lenders offer special programs for specific groups, such as veterans, teachers, and public service workers. Leveraging these resources can help reduce upfront costs and make the dream of homeownership a reality.

Planning for Future Financial Stability

Planning for your future financial stability is crucial once you become a homeowner. Building home equity over time can provide a substantial financial cushion and potentially allow you to refinance your mortgage under better terms. This can result in lower monthly payments or shorter loan terms, saving you money in the long run. Additionally, consider the long-term investment potential of your home. Real estate can be a valuable asset that appreciates over time, contributing positively to your overall financial portfolio. Regularly reviewing and adjusting your financial plan will help ensure that you remain on a stable and prosperous path. Incorporating home maintenance and improvement projects can also enhance your home’s value, further boosting your financial security.

FAQs

1. When should you buy your first house?

The best time to buy your first house is when you are financially stable, have a steady income, a good credit score, and have saved enough for a down payment and other associated costs. It’s also important to ensure that you can afford ongoing homeownership expenses.

2. How do I determine my budget for buying a house?

To determine your budget, assess your current income, expenses, and savings. Consider your debts, such as student loans or credit cards, and use mortgage calculators to estimate how much you can afford to spend on a home. Aim to keep your monthly housing costs (including mortgage, taxes, and insurance) within 28-30% of your gross monthly income.

3. Why is getting pre-approved for a mortgage important?

Getting pre-approved for a mortgage gives you a clear idea of how much you can borrow, which helps narrow your home search to properties within your price range. It also shows sellers that you are a serious buyer, potentially giving you an edge in competitive markets.

4. How much money should I save for a down payment?

It’s generally recommended to save at least 20% of the home’s purchase price for a down payment. This can help you secure a better mortgage rate, lower your monthly payments, and avoid private mortgage insurance (PMI). However, some loans allow for lower down payments if you qualify.

5. What is an emergency fund and why do I need one when buying a house?

An emergency fund is a savings account with three to six months’ worth of living expenses, set aside to cover unexpected costs like repairs or sudden job loss. As a homeowner, having an emergency fund ensures you can handle unexpected expenses without financial strain.

6. How can I improve my credit score before buying a house?

To improve your credit score, pay your bills on time, reduce your credit card balances, and avoid opening new credit accounts unless necessary. Regularly check your credit report for errors and address any issues promptly to ensure your score is as high as possible.

7. What are the additional costs of homeownership beyond the purchase price?

Beyond the purchase price, homeowners should budget for property taxes, homeowners insurance, maintenance and repair costs, and any homeowners association (HOA) fees. These costs can vary significantly depending on the property’s location and condition, so research thoroughly and plan accordingly.

Conclusion

In conclusion, buying a home is a major financial decision, and it’s important to be financially ready before taking the leap. By following these seven simple strategies, you can ensure that you are in a strong financial position to buy a home and handle the ongoing costs of homeownership. Remember, the more prepared you are, the more enjoyable and rewarding your homeownership experience will be.