- May 31, 2024

- Posted by: Finanalyz

- Category: Small Business Finances

In today’s fast-paced business environment, adapting quickly to new financial technologies is crucial for staying competitive. Neobanking, which involves digital-only banks offering a range of services like payments, loans, and savings accounts, is revolutionizing how businesses manage their finances. By leveraging advanced technology, neobanks provide unparalleled convenience, lower fees, faster transactions, superior user experiences, automated accounting features, diverse financial products, and robust security measures. In this blog post, we’ll explore these key reasons why neobanking is essential for modern businesses and how it can help your company thrive in the digital age.

Table of contents:

The Rise of Neobanking: A Game Changer for Businesses

Convenience: Banking on the Go

Speed Matters: Faster Payments with Neobanking

User Experience: Making Banking Intuitive

Streamlined Finances: Automated Accounting

Access to Financial Solutions: Beyond Basic Banking

The Rise of Neobanking: A Game Changer for Businesses

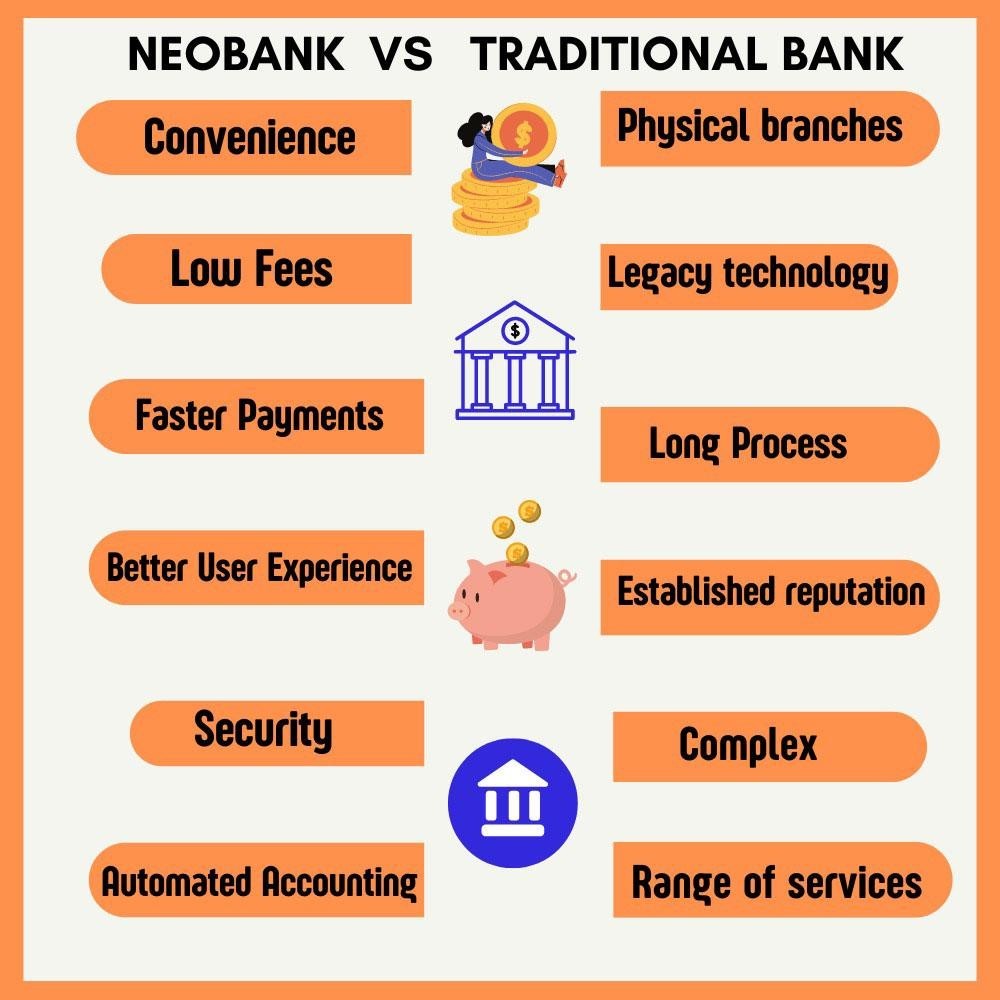

In today’s digital era, the landscape of banking is rapidly evolving, and neobanking stands at the forefront of this transformation. Neobanks, also known as digital banks or challenger banks, are revolutionizing the way businesses manage their finances. Unlike traditional brick-and-mortar banks, neobanks operate entirely online, leveraging cutting-edge technology to deliver a wide range of financial services tailored to the needs of modern businesses.

Neobanks offer an array of advantages over traditional banks, including streamlined processes, lower fees, faster transactions, and enhanced security measures. As businesses navigate the complexities of an increasingly competitive market, the adoption of neobanking has become not just a trend but a necessity for staying ahead in the game.

Convenience: Banking on the Go

The convenience of neobanking cannot be overstated. With just a few taps on a smartphone or clicks on a website, businesses can access their financial accounts, initiate transactions, and manage their cash flow from anywhere in the world. Gone are the days of waiting in long queues at bank branches or filling out endless paperwork. Neobanking empowers business owners to take control of their finances on their own terms, saving valuable time and resources in the process.

Whether it’s checking account balances, transferring funds, or paying bills, the intuitive interfaces of neobank mobile apps make banking tasks effortless and efficient. This unparalleled convenience ensures that businesses can focus their energy on driving growth and innovation rather than getting bogged down by administrative burdens.

Cutting Costs with Low Fees

One of the most compelling reasons for businesses to embrace neobanking is the significant cost savings it offers. Traditional banks often impose hefty fees and charges, ranging from monthly account maintenance fees to transaction fees and overdraft penalties. In contrast, neobanks operate with lower overhead costs, as they don’t maintain physical branches or incur expenses associated with legacy infrastructure.

As a result, neobanks can pass on these savings to their customers in the form of reduced fees and competitive interest rates. By minimizing banking costs, businesses can allocate more resources towards growth initiatives, investment opportunities, and expanding their operations, thereby enhancing their overall financial health and sustainability.

Speed Matters: Faster Payments with Neobanking

In today’s fast-paced business environment, speed is of the essence, especially when it comes to financial transactions. Neobanks excel in this regard, offering lightning-fast payment processing capabilities that enable businesses to send and receive funds with unprecedented speed and efficiency.

Whether it’s payroll processing, supplier payments, or invoicing clients, neobanks leverage advanced technology and real-time payment networks to ensure that transactions are executed swiftly and securely. This accelerated cash flow cycle can have a transformative impact on business operations, enabling companies to seize opportunities, mitigate risks, and maintain a competitive edge in their respective industries.

User Experience: Making Banking Intuitive

Neobanks prioritize user experience like never before, reimagining banking interfaces to be intuitive, interactive, and seamlessly integrated with the digital lifestyles of modern businesses. From sleek mobile apps to responsive web platforms, neobanks provide a user-friendly environment that simplifies financial management tasks and enhances overall satisfaction.

Business owners can easily navigate through their accounts, monitor transactions in real-time, set up automated alerts, and customize their preferences according to their specific needs. Moreover, neobanks leverage data analytics and machine learning algorithms to offer personalized insights and recommendations, empowering businesses to make informed decisions and optimize their financial performance.

Streamlined Finances: Automated Accounting

Neobanks go beyond basic banking services by offering sophisticated tools for automated accounting and financial reporting. Through seamless integration with accounting software and cloud-based platforms, businesses can automate tedious tasks such as transaction categorization, expense tracking, and reconciliation.

This automation not only saves time and reduces human error but also provides businesses with valuable insights into their financial health and performance metrics. By leveraging the power of data analytics, businesses can identify trends, uncover opportunities, and make strategic decisions that drive growth and profitability.

Access to Financial Solutions: Beyond Basic Banking

Neobanks empower businesses with access to a diverse range of financial products and services tailored to their unique needs and objectives. Whether it’s obtaining business loans, establishing lines of credit, or maximizing savings through high-yield accounts, neobanks offer a comprehensive suite of solutions to support every stage of the business lifecycle.

Moreover, neobanks leverage innovative technologies such as artificial intelligence and blockchain to develop innovative financial products that address emerging market demands and capitalize on new opportunities. By embracing these cutting-edge solutions, businesses can unlock new avenues for growth and achieve their strategic goals with confidence.

Security: Safeguarding Your Financial Data

In an age of increasing cyber threats and data breaches, security is paramount when it comes to financial transactions. Neobanks employ state-of-the-art security measures to protect their customers’ sensitive information and financial assets from unauthorized access and fraudulent activities.

From multi-factor authentication and biometric identification to encryption and real-time fraud monitoring, neobanks utilize a layered approach to security that ensures robust protection across every touchpoint of the banking experience. By prioritizing security, businesses can have peace of mind knowing that their financial data is safeguarded against evolving threats, allowing them to focus on driving growth and innovation without compromising confidentiality or integrity.

FAQs

What is neobanking and how does it differ from traditional banking?

Neobanking refers to digital-only banks that operate without physical branches, offering financial services like payments, loans, and savings accounts through mobile apps and websites. Unlike traditional banks, neobanks leverage advanced technology to provide a more streamlined, cost-effective, and user-friendly experience.

How can neobanking benefit my business?

Neobanking offers numerous benefits, including convenience (managing finances anytime, anywhere), lower fees, faster payments, enhanced user experience, automated accounting, access to a wide range of financial products, and advanced security measures.

Are neobanks secure?

Yes, neobanks use advanced security measures such as two-factor authentication, biometric identification, and encryption to protect customers’ data and finances, ensuring robust protection against unauthorized access and cyber threats.

What types of fees do neobanks typically charge?

Neobanks generally have lower fees compared to traditional banks due to their reduced overhead costs. Common fees include transaction fees, foreign exchange fees, and account maintenance fees, which are usually more affordable.

Can neobanks handle business loans and credit lines?

Yes, many neobanks offer a range of financial products, including business loans and credit lines, which can be accessed quickly and easily through their digital platforms, helping businesses manage their financial needs effectively.

How do neobanks enhance the user experience?

Neobanks provide a superior user experience through intuitive mobile apps and web interfaces, real-time updates, personalized financial insights, and streamlined processes, making it easier for businesses to manage their finances.

What automated accounting features do neobanks offer?

Neobanks offer automated accounting features such as transaction categorization, expense tracking, and financial reporting, which help businesses save time, reduce errors, and gain valuable insights into their financial health.

Conclusion

In conclusion, neobanking is transforming the financial landscape for modern businesses by offering unmatched convenience, reduced costs, faster transactions, an enhanced user experience, automated accounting, diverse financial products, and robust security measures. As businesses strive to remain competitive and efficient in today’s fast-paced environment, the adoption of neobanking solutions can provide significant advantages, making it an essential consideration for any forward-thinking company.