- April 12, 2024

- Posted by: Finanalyz

- Category: Investing for Beginners

In today’s fast-paced world, securing your financial future is more critical than ever. With numerous investment options available, navigating the investment landscape can feel overwhelming. However, there’s one approach that stands out for its simplicity and effectiveness: Systematic Investment Planning (SIP).

Table of contents:

What is SIP (Systematic Investment Planning)

Systematic Investment Planning Explained

Who should choose SIP?

What is SIP (Systematic Investment Planning)?

SIP, or Systematic Investment Planning, is a disciplined investment strategy that allows individuals to invest small amounts regularly over a period. It’s a methodical approach to wealth creation that offers several advantages over traditional lump-sum investments.

How Does SIP Work?

The concept behind SIP is straightforward. Instead of investing a large sum of money at once, investors commit to investing a fixed amount regularly, typically monthly, or quarterly, into mutual funds or other investment vehicles. These investments are then managed by professional fund managers, who allocate them across various asset classes based on the investment objectives of the fund.

Benefits of SIP

Rupee Cost Averaging:

SIP helps mitigate the impact of market volatility through rupee cost averaging. When markets are down, your fixed investment buys more units, and when markets are up, it buys fewer units. Over time, this averaging helps reduce the overall cost per unit of investment.

Discipline and Regularity:

SIP instils financial discipline by encouraging regular investments. By automating the investment process, investors are less likely to submit to emotional decision-making driven by market fluctuations.

Power of Compounding:

One of the most significant advantages of SIP is the power of compounding. By reinvesting returns, investors can benefit from exponential growth over the long term, even with relatively small initial investments.

Flexibility:

SIPs offer flexibility in terms of investment amount and frequency. Investors can increase, decrease, or pause their investments as per their financial circumstances and investment goals.

Who Should Consider SIP?

SIP is suitable for investors across all age groups and financial backgrounds. Whether you’re a young professional just starting to build your investment portfolio or a seasoned investor looking to diversify your holdings, SIP offers a flexible and effective way to achieve your financial goals.

Systematic Investment Planning Explained

Investing a fixed amount of money into any financial asset at regular intervals.

For example: If you invest 5,000 Rupees into UTI Nifty 50 Mutual Fund on the 1st of every month that you can call as an SIP.

How SIP helps in Compounding?

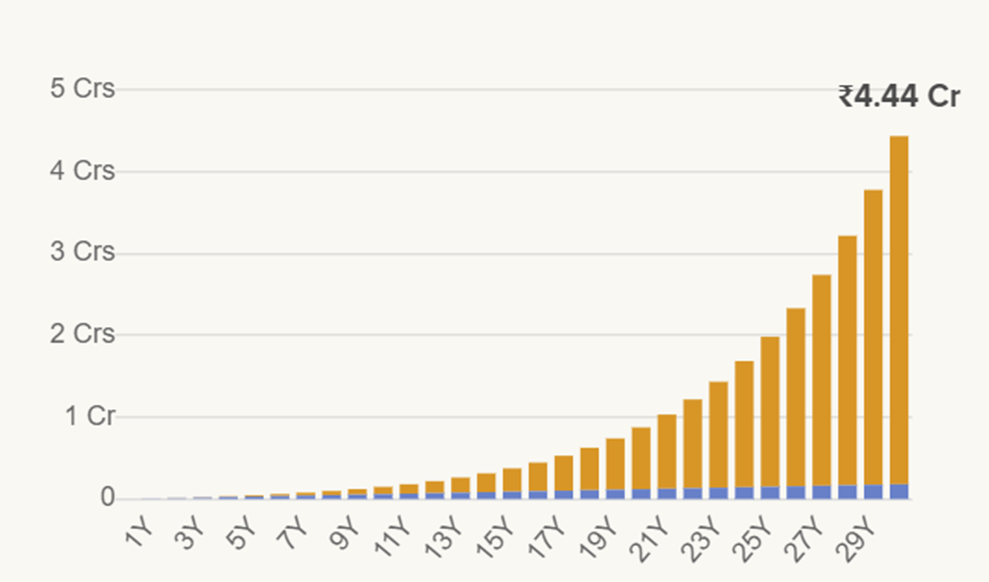

You are doing an SIP of ₹ 5,000 for the next 30 years and XIRR is 16%.

Total Invested amount is ₹5,000 * 12 months * 30 years = ₹18,00,000

Final value will be: ₹ 4.44 Crores.

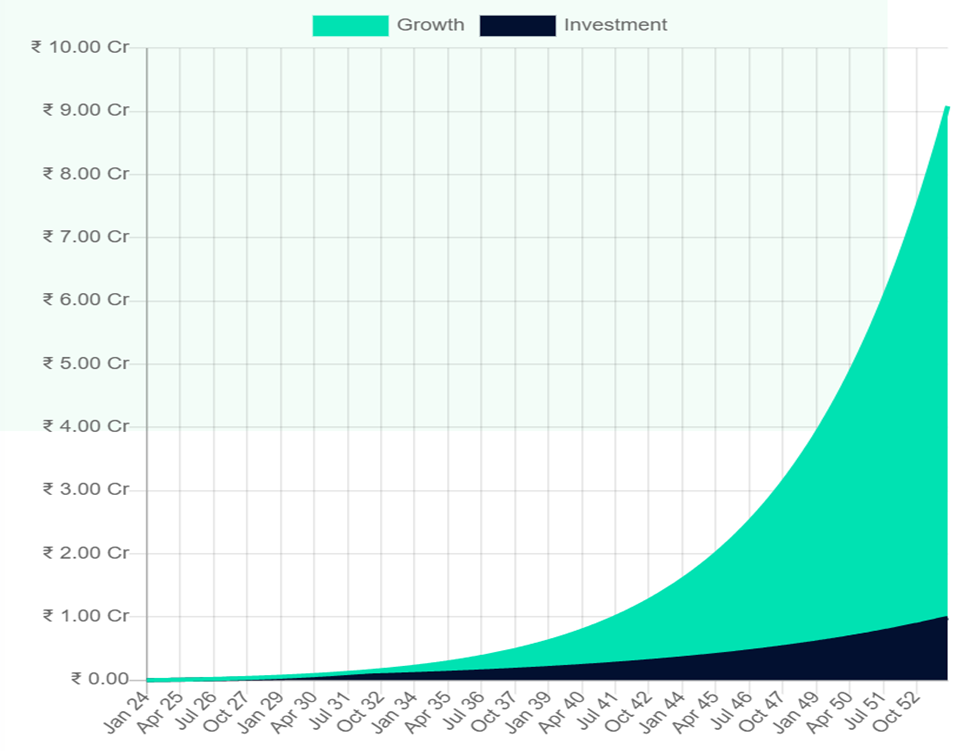

Step-up SIP:

As you grow your earnings will also be growing, that defines success in your career. As a advantage of your successful career increase your SIP by a certain %, world calls it Step-up %

For Example:

If your Step-up % is 10%. Your SIP increases as follows.

|

Year |

SIP Amount |

|

Year 1 |

5,000 |

|

Year 2 |

5,500 |

|

Year 3 |

6,050 |

and so on………

Let’s see how much money your will make after 30 years for XIRR of 16%

Your final value will double to Rs 9 Crores.

Who should choose SIP?

Everyone can master in their own field and becoming master in some other field which you are not practicing is tough. So, if you are not into Finance actively choose SIP into assets.

SIP concept is widely used in Mutual Fund Investment. Start using SIP concepts and build your financial assets.

FAQs

What is Systematic Investment Planning (SIP)?

SIP is a disciplined investment strategy where investors regularly contribute a fixed amount into mutual funds or other investment vehicles over time, aiming for long-term wealth accumulation.

How does SIP differ from lump-sum investments?

Unlike lump-sum investments where a large amount is invested at once, SIP involves investing smaller amounts at regular intervals. This approach helps mitigate the effects of market volatility through rupee cost averaging.

What are the benefits of SIP?

SIP offers several benefits, including disciplined investing, rupee cost averaging, the power of compounding, flexibility in investment amount and frequency, and the ability to participate in the financial markets with relatively small amounts of money.

Who is SIP suitable for?

SIP is suitable for investors of all ages and financial backgrounds. Whether you’re a beginner looking to start investing with limited funds or a seasoned investor seeking a systematic approach to portfolio management, SIP can align with your investment goals.

How do I start a SIP?

Starting a SIP is simple. You can begin by selecting a mutual fund or investment scheme that aligns with your financial objectives and risk tolerance. Then, set up a SIP account with a registered fund house or financial institution, determine your investment amount and frequency, and initiate regular contributions.

Conclusion

In conclusion, Systematic Investment Planning (SIP) is a powerful tool for wealth creation and financial security. By harnessing the principles of discipline, regularity, and compounding, SIP empowers investors to navigate the complexities of the financial markets with confidence. Whether your goal is to save for retirement, fund your child’s education, or build a nest egg for the future, SIP can help you turn your aspirations into reality. So why wait? Start your SIP journey today and take control of your financial future.